Why I Wrote Retirement: It’s Personal (and What Surprised Me Most)

The moment I realised retirement planning was missing something

Over the years, I’ve met plenty of people who looked “fine on paper”.

Good pensions. Decent savings. Mortgage nearly gone.

And yet, the conversation often ended with the same sentence:

“I think I can retire… but I’m not sure.”

That uncertainty isn’t a spreadsheet problem. It’s a human problem.

What people really worry about (but rarely say out loud)

When people say, “I’m not sure I can retire,” they often mean:

-

“What if I run out of money?”

-

“What if I regret stopping work?”

-

“What if I lose my routine, confidence, or identity?”

-

“What if my partner and I want different things?”

-

“What if I retire and feel flat?”

These are normal fears. The issue is: most retirement planning content treats them as irrelevant.

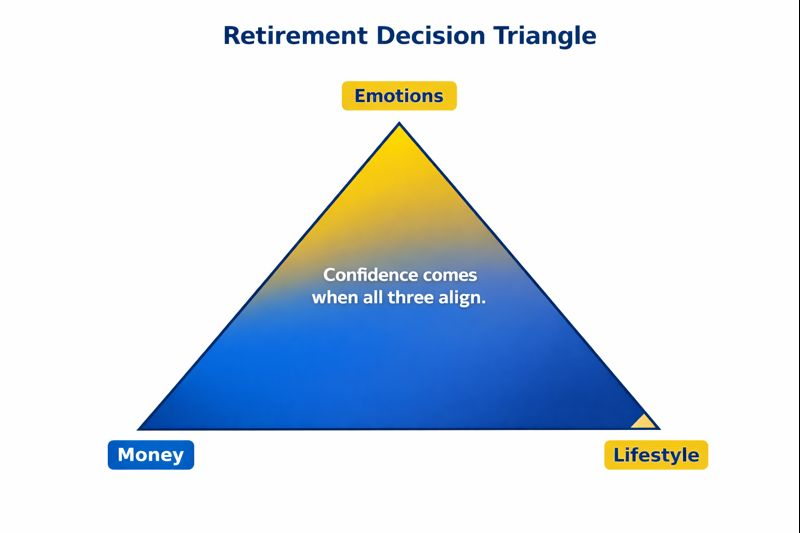

The three-part framework that kept showing up

When I stepped back, it became clear that successful retirements tend to align three things:

-

Money

Not just “how much you have” — but how it will be used, accessed, and protected. -

Emotions

Confidence, control, freedom, fear, identity, timing, and avoiding “what if” regret. -

Lifestyle

A real plan for your weeks, your purpose, your relationships, and what makes it worthwhile.

If one of these is ignored, retirement can still happen… but it often doesn’t feel how people hoped.

What surprised me most while writing

I expected the “money” parts to be the hardest. In reality, the most important sections were:

-

The chapters that help readers define what they want

-

The parts that help couples get aligned

-

The prompts that reveal what retirement is really about for you

Because when lifestyle is clear and emotions settle, money planning becomes more purposeful.

Why I made it practical (not fluffy)

This isn’t a motivational book. It’s a practical one.

The tone is simple on purpose: retirement can feel complicated enough already. My goal is to give you clarity you can act on.

If you’re reading this and thinking “I’m nearly there, but…”

That “but” matters.

Retirement is personal. It deserves more than guesswork.